What To Look For From This Week’s Fed Meeting

As the Federal Reserve meets this week, real estate professionals, including our team, are closely monitoring potential impacts on the housing market, especially for Chicago homes. While the Fed’s decision on the Federal Funds Rate doesn’t set mortgage rates directly, it can influence them significantly.

MPG understands that clients may be concerned about how these decisions could affect buying or selling in the Chicago area. Here’s what you need to know to navigate the current market, with insights from our real estate experts:

Key Economic Indicators Influencing the Fed’s Decision

Inflation Direction

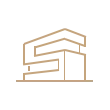

You’ve likely noticed prices for everyday goods and services seem to be higher each time you make a purchase at the store. That’s because of inflation – and the Fed wants to see that number come back down so it’s closer to their 2% target.Right now, it’s still higher than that. But despite a little volatility, inflation has generally been moving in the right direction. It gradually came down over the past two years, and is holding fairly steady right now (see graph below):

2. How Many Jobs the Economy Is Adding

The Fed is also keeping an eye on how many new jobs are added to the economy each month. They want job growth to slow down a bit before they cut the Federal Funds Rate further. When fewer jobs are created, it shows the economy is still doing well, but gradually cooling off—exactly what they’re aiming for. And that’s what’s happening right now. Reuters says:

“Any doubts the Federal Reserve will go ahead with an interest-rate cut . . . fell away on Friday after a government report showed U.S. employers added fewer workers in October than in any month since December 2020.”

Employers are still hiring, but just not as many positions right now. This shows the job market is starting to slow down after running hot for a while, which is what the Fed wants to see.

3. The Unemployment Rate

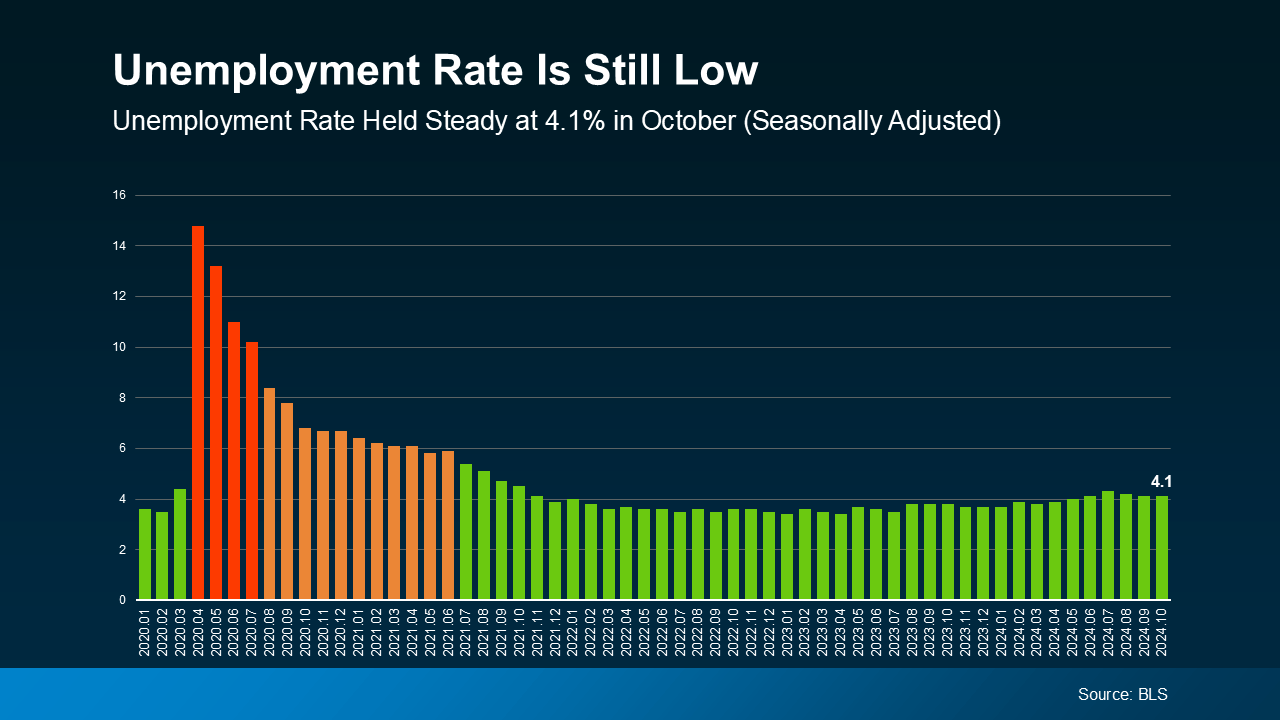

The unemployment rate shows the percentage of people who want jobs but can’t find them. A low unemployment rate means most people are working, which is great. However, it can push inflation higher because more people working means more spending—and that makes prices go up.

Many economists consider any unemployment rate below 5% to be as close to full employment as is realistically possible. In the most recent report, unemployment is sitting at 4.1% (see graph below):

What Does This Mean for Real Estate in Chicago?

If the Fed reduces rates as expected, mortgage rates could begin to ease, though not immediately. Forecasts suggest a gradual decrease over 2024 and 2025, creating more opportunities for buyers and sellers. However, unexpected economic shifts could alter the outlook, so some market volatility is possible.

Connect with us---we’re happy to help you make informed decisions in this evolving landscape. Our team is well-equipped to provide the latest insights and guidance to help you achieve your real estate goals in Chicago.

Office Hours:

Monday to Friday

8:00 am to 5:00 pm

Email: [email protected]

Call +17087322828

Office: Chicago, IL 60657